Survey: Mood darkens among seafood executives, but most expect M&As, CAPEX to continue

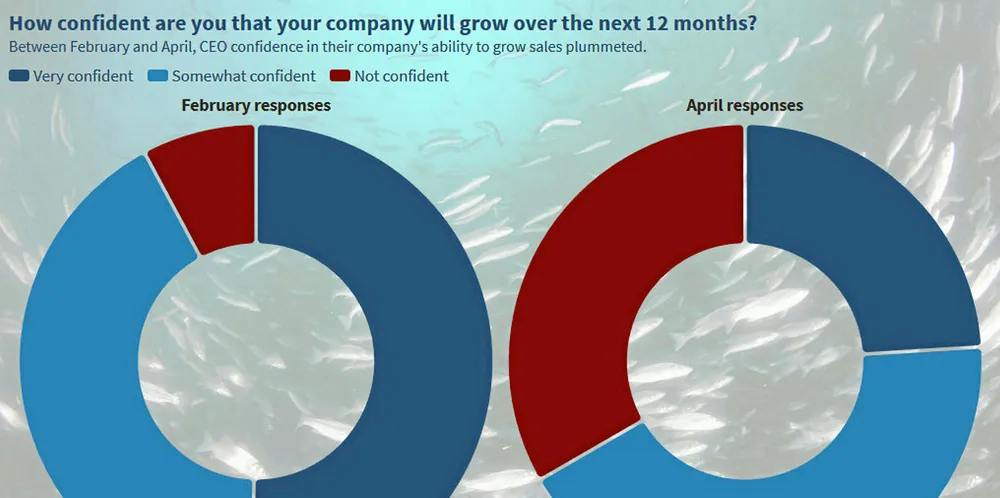

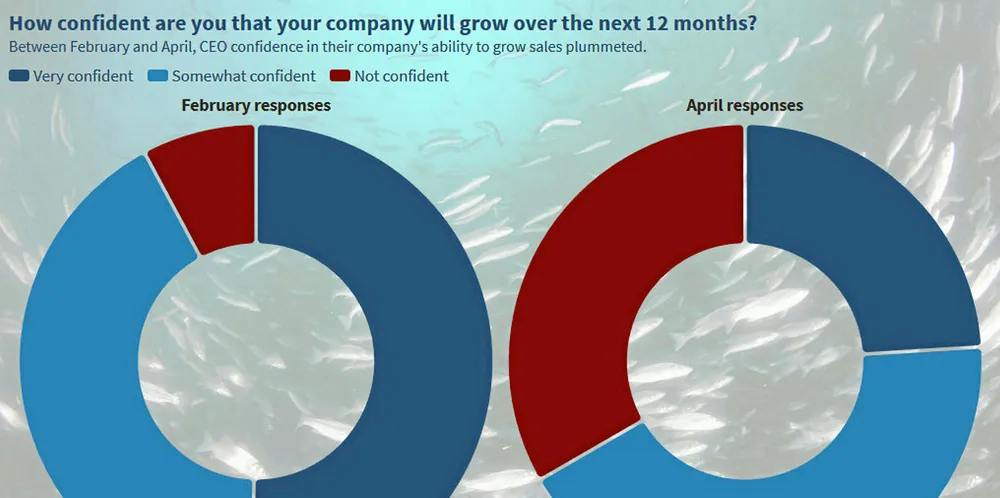

Confidence in company growth over next 12 months plummeted, according to surveys conducted before and during coronavirus.

Confidence in company growth over next 12 months plummeted, according to surveys conducted before and during coronavirus.