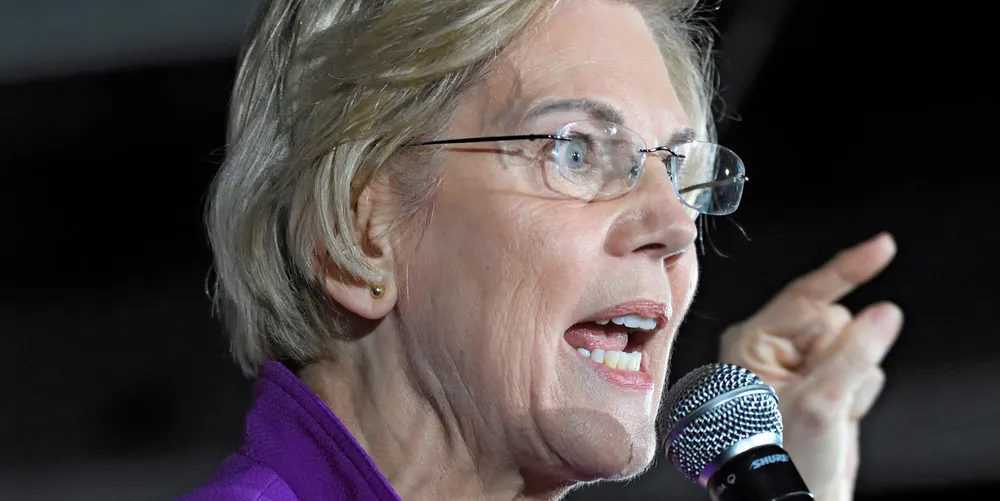

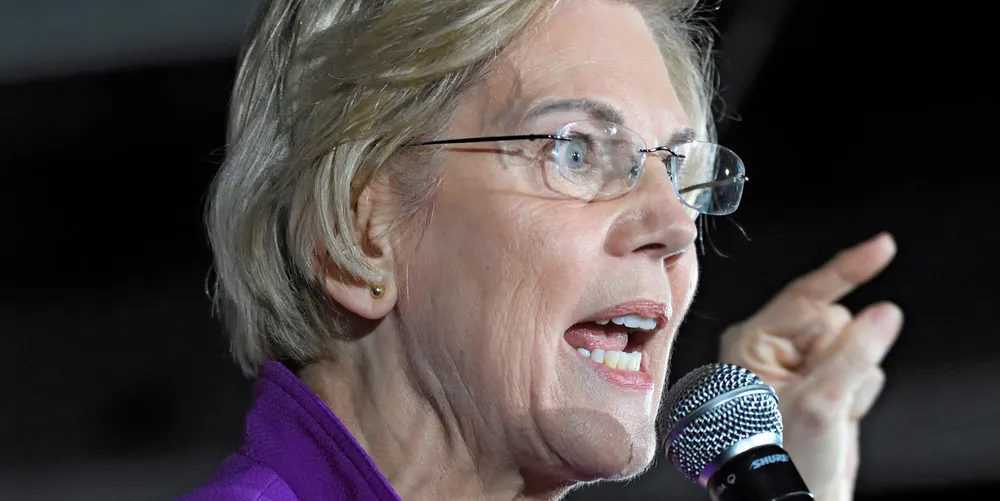

US lawmakers probing alleged malfeasance related to Blue Harvest bankruptcy

The lawmakers are seeking details on the company's failure to pay over $100 million in debts.

The lawmakers are seeking details on the company's failure to pay over $100 million in debts.