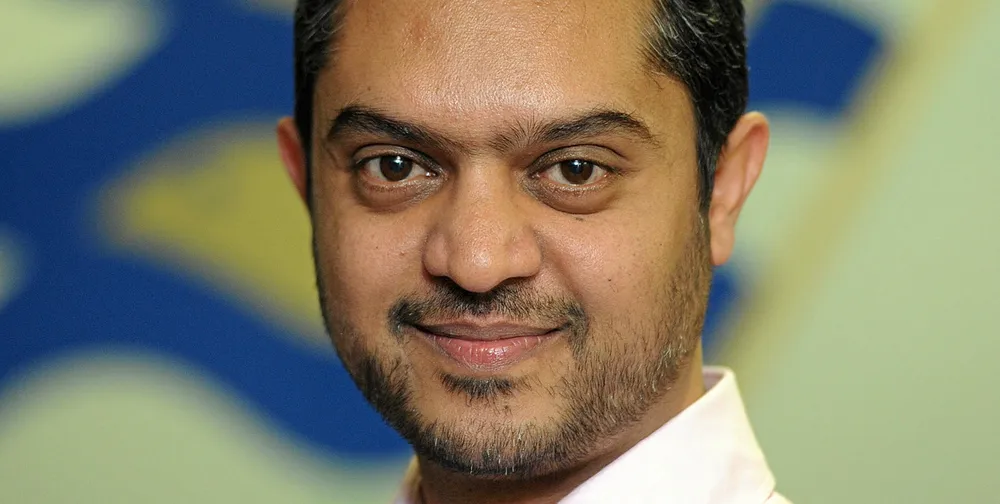

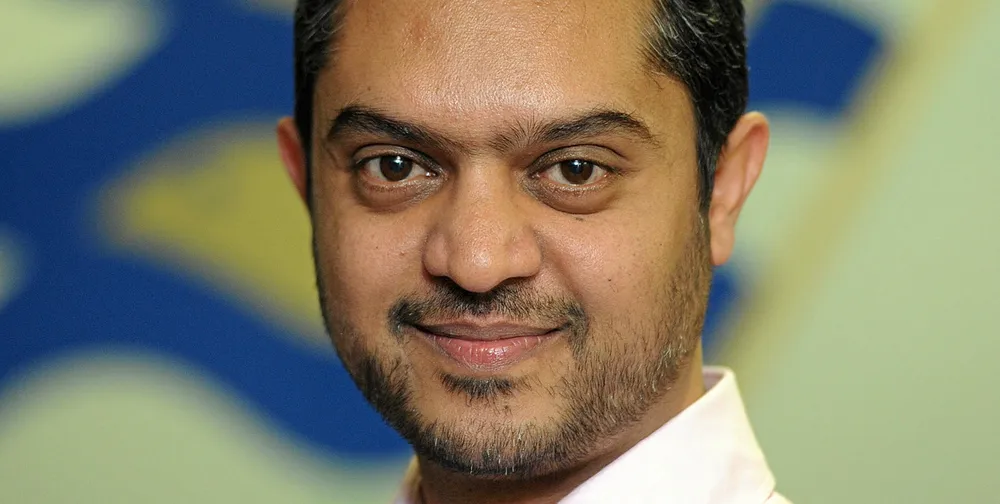

CEO of South African fishing giant Oceana abruptly resigns; US subsidiary Daybrook Fisheries under scrutiny

The move comes just a week after Oceana placed its CFO Hajra Karrim on a ‘precautionary’ suspension.

The move comes just a week after Oceana placed its CFO Hajra Karrim on a ‘precautionary’ suspension.